Press Releases

19-09-2018 12:01

EUR 1.5 billion 2.375% new 10-year benchmark due 25 September 2028

The Public Debt Management Office, Ministry of Finance, announces the following:

THESE MATERIALS ARE NOT AN OFFER FOR SALE OF THE SECURITIES IN THE UNITED STATES. SECURITIES MAY NOT BE SOLD IN THE UNITED STATES ABSENT REGISTRATION OR AN EXEMPTION FROM REGISTRATION UNDER THE U.S. SECURITIES ACT OF 1933, AS AMENDED. THE REPUBLIC OF CYPRUS DOES NOT INTEND TO REGISTER ANY PORTION OF THE OFFERING IN THE UNITED STATES OR TO CONDUCT A PUBLIC OFFERING OF SECURITIES IN THE UNITED STATES.

The Republic of Cyprus rated Ba2/BBB-/BB+/BB (stable/stable/positive/positive) by Moody's/S&P/Fitch/DBRS has today issued a new EUR1.5bn RegS fixed rate benchmark due 25 September 2028. The deal pays a coupon of 2.375% and has a reoffer yield of 2.400%, equivalent to a spread of +143.5bp over mid-swaps and +192.5bp over the DBR 0.250% Aug-28. The joint lead managers of this transaction are BARCLAYS, J.P. MORGAN, MORGAN STANLEY and SG CIB. The new bond will be listed on the London Stock Exchange in accordance with English law via the Republic of Cyprus’s EMTN programme (ISIN: XS1883942648).

Execution Highlights

• The Republic of Cyprus, via the Public Debt Management Office, had been actively monitoring market conditions and opportunities for debt issuance in international capital markets throughout 2018.

• This week was chosen as a suitable window for issuance, taking advantage of supportive underlying conditions in the international capital markets, as well as following an upgrade from Standard & Poor’s to investment grade (BBB-). The ratings action brings Cyprus back to investment grade status for the first time since 2012.

• The Republic of Cyprus officially announced its mandate for a new 10yr benchmark the morning of Monday, 17th September 2018, with pricing expected in the near future subject to market conditions. With the mandate announcement, a netroadshow was also released in order to inform investors of the latest economic developments in the country.

• At 8.02 GMT the morning of Tuesday, 18th September 2018, initial pricing thoughts (“IPTs”) were released for the new 10yr benchmark at 2.60% area. The transaction attracted sizable investor interest, and with indications of interest (“IoIs”) in excess of €3bn (excl. JLM interest), at 9:05 GMT the orderbook officially opened, with revised guidance of 2.50% area.

• The orderbook continued to grow with orders totaling in excess of €4.75bn (excl. JLM interest) by 10:11 GMT, which allowed the reoffer yield to be set at 2.40%. Shortly thereafter at 10:56 GMT, a €1.5bn transaction issue was launched, given the size and quality of the orders received. The orderbook closed at 11:00 GMT with a final size of € 5.675bn (excl. JLM interest) and approx. 279 different investors participating in the transaction, representing the largest orderbook Cyprus has achieved since its return to markets in June 2014.

• At 15:44 GMT, the transaction officially priced with a reoffer of 2.40%, equivalent to a spread of +143.5bp over mid-swaps and +192.5bp over the DBR 0.250% Aug-28.

• Ahead of announcement, fair value was identified by the lead manager group as approximately 2.25%. This was derived from Cyprus’ existing bond trading levels and by analyzing the steepness of peer sovereign curves out to the 10-year maturity. This analysis implies a new issue concession for the new transaction of approximately 15bp.

• The new 10yr benchmark, which extends the existing Cyprus yield curve, represents the lowest reoffer yield (2.40%) and the lowest coupon (2.375%) that the Republic of Cyprus has ever achieved in international capital markets for a benchmark size Euro-denominated syndicated issuance. By notional size, it is also the largest syndicated Euro transaction from the sovereign since the return to capital markets in 2014, and matches the largest ever transaction for the sovereign in this currency.

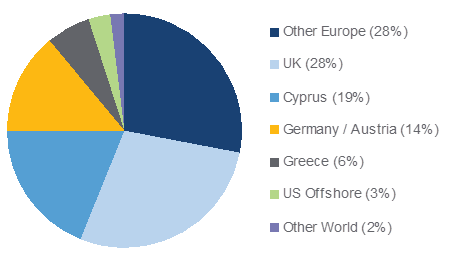

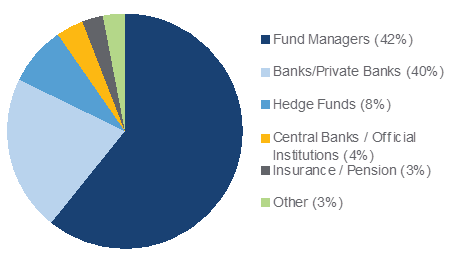

Summary of distribution

• By geography, the Republic of Cyprus has achieved a broad distribution, comprised largely of international investors across Europe (28%) and the UK (28%).

• By investor type, the quality of the orderbook was high with real-money demand dominating the orderbook. Fund Managers were the largest investor class at 42%, closely followed by banks and private banks (40%).

Distribution by Region

Distribution by Type

Summary of Terms and Conditions

|

Issuer |

The Republic of Cyprus |

|

Issuer Ratings |

Ba2 (sta)/BBB- (sta)/BB+ (pos)/BB (pos) (Moody's/S&P/Fitch/DBRS) |

|

Format |

Reg S Registered only, CACs |

|

Size |

EUR 1.5bn |

|

Maturity Date |

25 September 2028 |

|

Settlement Date |

25 September 2018 (T+5) |

|

Coupon |

2.375%, Annual, ACT/ACT |

|

Reoffer |

99.780 / 2.40% p.a. |

|

Spread vs. Mid Swaps |

+143.5bps vs. 10yr Swap Rate spot @ 0.965% |

|

Spread vs. BM |

+192.5bps vs. DBR 0.250% Aug-28 spot @ 97.830 / 0.475% |

|

Denominations |

1k+1k |

|

Law/Listing |

English Law / London Stock Exchange |

|

Target Market |

Eligible counterparties, Professional clients and Retail clients (all distribution channels) |

|

Docs |

EMTN Programme |

|

ISIN |

XS1883942648 |

|

Joint Lead Managers |

BARC/JPM(B&D)/MS/SG CIB |

DISCLAIMER

This document has been prepared by the Joint Lead Managers for information purposes only. This document is an indicative summary of the terms and conditions of the transaction described herein and may be amended, superseded or replaced by subsequent summaries. The final terms and conditions of the transaction and any related security will be set out in full in the applicable offering document(s), pricing supplement or binding transaction document(s).

This document shall not constitute an underwriting commitment, an offer of financing, an offer to sell, or the solicitation of an offer to buy any securities described herein, which shall be subject to the Joint Lead Managers’ internal approvals and satisfaction of all appropriate conditions precedent. No transaction or service related thereto is contemplated without the Joint Lead Managers' subsequent formal agreement.

The Joint Lead Managers are not responsible for providing or arranging for the provision of any general financial, strategic or specialist advice, including legal, regulatory, accounting, model auditing or taxation advice or services or any other services in relation to the transaction and/or any related securities described herein. The Joint Lead Managers are acting solely in the capacity of arms’ length contractual counterparty and not as adviser, agent or fiduciary to any person. The Joint Lead Managers accept no liability whatsoever to the fullest extent permitted by law for any consequential losses arising from the use of this document or reliance on the information contained herein.

The Joint Lead Managers do not guarantee the accuracy or completeness of information which is contained in this document and which is stated to have been obtained from or is based upon trade and statistical services or other third party sources. Any data on past performance, modelling, scenario analysis or back-testing contained herein is no indication as to future performance. No representation is made as to the reasonableness of the assumptions made within or the accuracy or completeness of any modelling, scenario analysis or back-testing. All opinions and estimates are given as of the date hereof and are subject to change. The value of any investment may fluctuate as a result of market changes. The information in this document is not intended to predict actual results and no assurances are given with respect thereto.

The securities described herein have not been and will not be registered under the U.S. Securities Act of 1933, as amended (the "Securities Act") and may not be offered or sold within the United States or to or for the account or benefit of U.S. persons, as defined in Regulation S under the Securities Act. This document is not intended for distribution to and must not be passed on to any retail client.

NO ACTION HAS BEEN MADE OR WILL BE TAKEN THAT WOULD PERMIT A PUBLIC OFFERING OF ANY SECURITIES DESCRIBED HEREIN IN ANY JURISDICTION IN WHICH ACTION FOR THAT PURPOSE IS REQUIRED. NO OFFERS, SALES, RESALES OR DELIVERY OF ANY SECURITIES DESCRIBED HEREIN OR DISTRIBUTION OF ANY OFFERING MATERIAL RELATING TO ANY SUCH SECURITIES MAY BE MADE IN OR FROM ANY JURISDICTION EXCEPT IN CIRCUMSTANCES WHICH WILL RESULT IN COMPLIANCE WITH ANY APPLICABLE LAWS AND REGULATIONS AND WHICH WILL NOT IMPOSE ANY OBLIGATION ON THE JOINT LEAD MANAGERS OR ANY OF THEIR AFFILIATES.

The Joint Lead Managers, their affiliates and the individuals associated therewith may (in various capacities) have positions or deal in transactions or securities (or related derivatives) identical or similar to those described herein.

This document is confidential, and no part of it may be reproduced, distributed or transmitted without the prior written permission of the Joint Lead Managers.

(ML)

Relevant Press Releases

28-03-2025 18:12

European Statistics Competition, National Phase

28-03-2025 15:13

Industrial Production Index: January 2025

27-03-2025 21:02

Imports, Sales and Stocks of Petroleum Products: February 2025

21-03-2025 18:35

Household Budget Survey: 2023