Press Releases

22-04-2024 14:42

Excessive deficit procedure and annual accounts of General Government: 2023

Surplus €918,7 mn

The Statistical Service announces the fiscal results for 2023, which have been audited and verified within the Excessive Deficit Procedure framework of the European Commission.

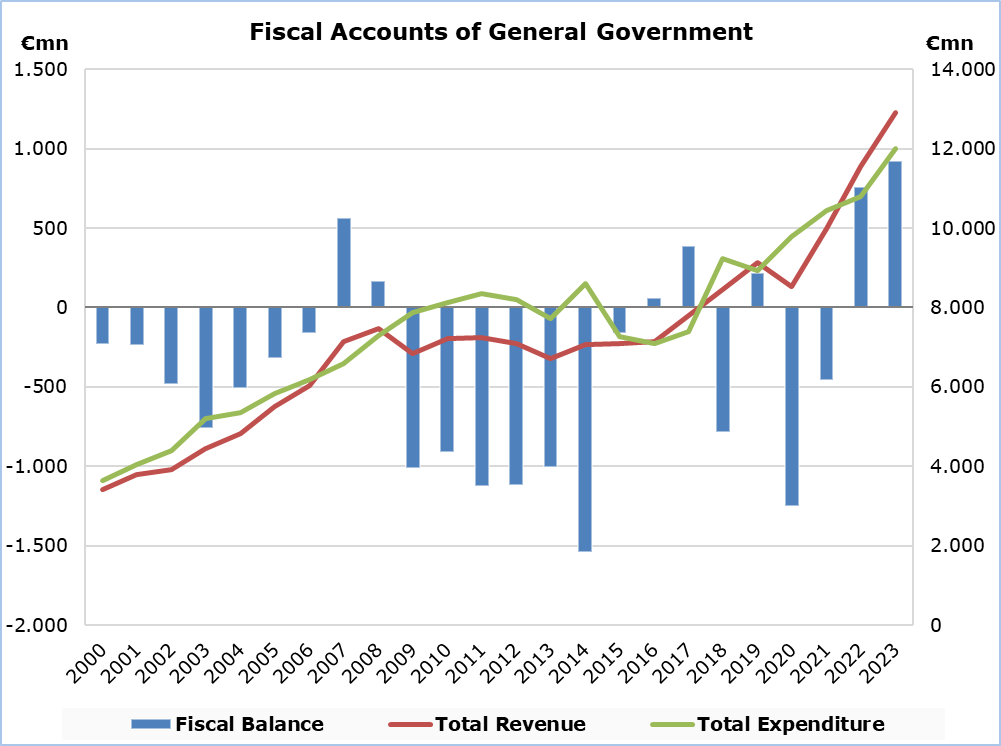

The results for 2023 indicate a fiscal surplus of €918,7 mn, which corresponds to 3,1% of GDP and a fiscal debt of €23.036,4 mn, which corresponds to 77,3% of GDP.

Revenue

In 2023, total revenue increased by €1.374,0 mn (+11,9%) and amounted to €12.913,8 mn, compared to €11.539,8 mn in 2022.

In detail, taxes on production and imports increased by €403,6 mn (+10,0%) and amounted to €4.437,1 mn, compared to €4.033,5 mn in 2022, of which net VAT revenue increased by €273,1 mn (+10,1%) and amounted to €2.978,8 mn, compared to €2.705,7 mn in 2022. Social contributions increased by €451,7 mn (+14,5%) and amounted to €3.573,7 mn, compared to €3.122,0 mn in 2022. Revenue from taxes on income and wealth increased by €340,7 mn (+11,7%) and amounted to €3.264,9 mn, compared to €2.924,2 mn in 2022. Other current transfers increased by €56,8 mn (+22,3%) and amounted to €311,2 mn, compared to €254,4 mn in 2022. Property income receivable increased by €19,9 mn (+17,4%) and amounted to €134,1 mn, compared to €114,2 mn in 2022. Revenue from the sale of goods and services increased by €29,8 mn (+3,7%) and amounted to €835,9 mn, compared to €806,1 mn in 2022. Capital transfers increased by €71,5 mn (+25,1%) and amounted to €356,9 mn, compared to €285,4 mn in 2022.

Expenditure

In 2023, total expenditure increased by €1.213,3 mn (+11,3%) and amounted to €11.995,1 mn, from €10.781,8 mn in 2022.

Specifically, compensation of employees (including imputed social contributions and pensions of civil servants) increased by €408,0 mn (+12,8%) and amounted to €3.587,2 mn, compared to €3.179,2 mn in 2022. Social transfers increased by €320,9 mn (+7,6%) and amounted to €4.532,6 mn, compared to €4.211,7 mn in 2022. Other current expenditure increased by €174,9 mn (+26,9%) and amounted to €824,8 mn, compared to €649,9 mn in 2022. Property income payable increased by €20,9 mn (+5,1%) and amounted to €431,5 mn, compared to €410,6 mn in 2022. Subsidies increased by €24,3 mn (+17,4%) and amounted to €163,6 mn, compared to €139,3 mn in 2022.

Total capital expenditure increased by €307,9 mn (+32,4%) and amounted to €1.258,4 mn (€1.037,8 mn gross capital formation and €220,6 mn other capital expenditure), compared to €950,5 mn (€728,7 mn gross capital formation and €221,8 mn other capital expenditure) in 2022.

On the contrary, intermediate consumption decreased by €43,6 mn (-3,5%) to €1.197,0 mn, from €1.240,6 mn in 2022.

|

Table |

||||

|

Macroeconomic Aggregates of General Government |

Euro (million) |

Change |

||

|

Fiscal Results |

Difference |

(%) |

||

|

2022 |

2023 |

2023/ 2022 |

2023/ 2022 |

|

|

Total Revenue |

11.539,8 |

12.913,8 |

1.374,0 |

11,9 |

|

Taxes on Production and Imports |

4.033,5 |

4.437,1 |

403,6 |

10,0 |

|

of which VAT |

2.705,7 |

2.978,8 |

273,1 |

10,1 |

|

Current Taxes on Income and Wealth, etc |

2.924,2 |

3.264,9 |

340,7 |

11,7 |

|

Social Contributions |

3.122,0 |

3.573,7 |

451,7 |

14,5 |

|

Other Current Resources |

1.174,7 |

1.281,2 |

106,5 |

9,1 |

|

Property income receivable |

114,2 |

134,1 |

19,9 |

17,4 |

|

Current transfers |

254,4 |

311,2 |

56,8 |

22,3 |

|

Sales |

806,1 |

835,9 |

29,8 |

3,7 |

|

Capital Transfers Received |

285,4 |

356,9 |

71,5 |

25,1 |

|

Total Expenditure |

10.781,8 |

11.995,1 |

1.213,3 |

11,3 |

|

Total Current Expenditure |

9.831,3 |

10.736,7 |

905,4 |

9,2 |

|

Intermediate consumption |

1.240,6 |

1.197,0 |

-43,6 |

-3,5 |

|

Compensation of employees |

3.179,2 |

3.587,2 |

408,0 |

12,8 |

|

Social transfers |

4.211,7 |

4.532,6 |

320,9 |

7,6 |

|

Property income payable |

410,6 |

431,5 |

20,9 |

5,1 |

|

Subsidies |

139,3 |

163,6 |

24,3 |

17,4 |

|

Other current expenditure |

649,9 |

824,8 |

174,9 |

26,9 |

|

Total Capital Expenditure |

950,5 |

1.258,4 |

307,9 |

32,4 |

|

Gross capital formation |

728,7 |

1.037,8 |

309,1 |

42,4 |

|

Other capital expenditure |

221,8 |

220,6 |

-1,2 |

-0,5 |

|

Net Lending (+)/ Borrowing (-) |

758,0 |

918,7 |

160,7 |

|

|

% of GDP |

2,7% |

3,1% |

|

|

Methodological Information

Data Coverage and Methodology

Information is provided for the whole sequence of accounts for the General Government sector. The revenue and expenditure are analysed by category and these are classified between current and capital, respectively.

The categories of revenue and expenditure for General Government cover all the subsectors of the General Government based on the European System of Accounts 2010 (ESA 2010).

Source of Data

The data is collected from:

-Financial Information Management Automation System (FIMAS) for Central Government and Extra Budgetary Funds,

- Financial statements of Municipalities and Communities,

- Financial statements of Semi-Government Organizations,

- Financial Statements of Social Security Funds.

For the completion of the estimates, any methodological adjustments or corrections based on the European System of Accounts 2010 (ESA 2010) are taken into account.

For more information please visitCYSTAT Portal, subtheme Public Finance, CYSTAT-DB (Online Database), Predefined Tables (Excel), Methodological Information or contact Ms Christodoulou Antigoni: Τel: +35722602179, Email: achristodoulou@cystat.mof.gov.cy

The Predefined Tables, available in Excel format, include data up to 2022.

Data from 2023 onwards will be available only in the CYSTAT-DB Online Database.

(IA/NZ)

Relevant Press Releases

18-11-2024 14:15

Price Index of Construction Materials: October 2024

15-11-2024 15:12

Road Freight Transport: 2nd Quarter 2024

14-11-2024 13:52

GDP Growth Rate: 3rd quarter 2024 (Flash Estimate)