Press Releases

20-02-2019 14:48

Announcement of the Public Debt Management Office on the successful transaction of the new 15 year senior unsecured notes

Background

- The objectives of the transaction were in line with the stated Public Debt Management Strategy of the Republic of Cyprus to continue building out an international bond yield curve, manage refinancing risk by smoothening out and lengthening the debt maturity profile, enhance investor relations and expand the existing investor base

Highlights of the Transaction

- Following its successful funding exercises completed over the course of 2017 and continued market access last year, the Republic of Cyprus launched a new EUR1bn 15 year benchmark transaction, due 26th February 2034

- Prior to the launch of the transaction, the Republic of Cyprus had conducted extensive marketing efforts, targeting investors in London, Paris, Milan, Munich and Frankfurt. Based on positive feedback from these meetings, the issuer opted for the 15 year maturity and a target EUR1bn in size

- The mandate for a new EUR 15 year benchmark was officially announced to the market on Monday 18th February at 12:43 CET. Initial price thoughts of MS+200bps area were released around 08:54 CET on Tuesday 19th February, to gather indications of interest

- On the back of the strong investor demand with interest reaching in excess of EUR 6bn (incl. EUR750mm JLM interest), books were officially opened on Tuesday, 19th February at 10:46 CET, with a revised price guidance of MS+185bps area

- Demand continued to grow throughout the European morning, with strong interest from the international investor community, allowing the issuer to set the size at EUR1bn and further tighten the spread by 10bps and set at MS+175bps, thereby announcing closure of books at 12:30 CET

- Final demand of over EUR 8.1bn represents the largest orderbook achieved by a Republic of Cyprus benchmark transaction since the sovereign’s return to the international bond markets in June 2014

- The deal was priced at 17:44 CET with a cash price of 99.903% and a re-offer yield of 2.758%, thereby offering a minimal new issue concession over the theoretical fair value of the transaction

- The success of this transaction highlights the strong support from the international investor base for the Republic of Cyprus

Distribution Statistics

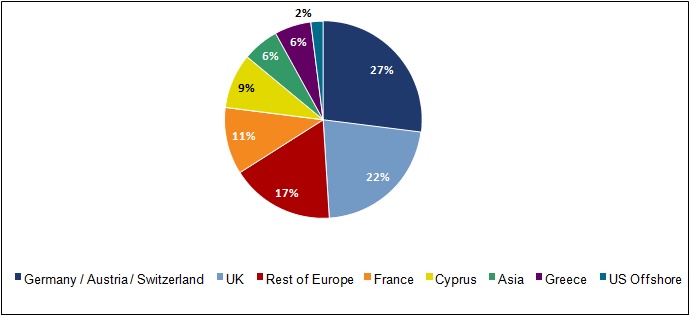

- The transaction saw a strong and diversified international participation, with domestic investors accounting for only 9% of the final allocations, with investors from the German regions being the largest region represented with 27% of the trade

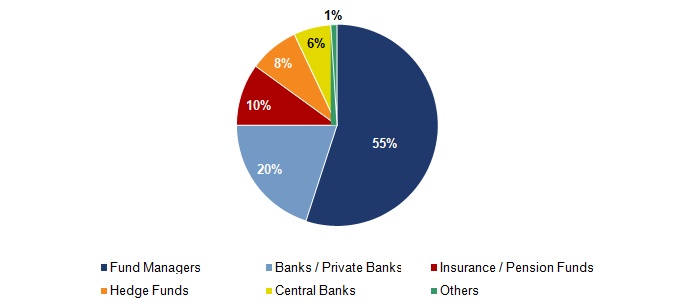

- By type, Fund Managers took the lion’s share with 55% of the allocations, followed by Banks (20%) and Insurance/Pension Funds (10%)

By geography:

By investor type:

The Republic of Cyprus

EUR 1.0 billion 15yr Benchmark due 26 February 2034 Final Terms and Conditions

|

Issuer |

The Republic of Cyprus, acting through the Public Debt Management Office, Ministry of Finance |

|

Issuer Ratings |

BBB-/Ba2/BBB-/BBBL (stab/stab/stab/stab) by S&P, Moody’s, Fitch and DBRS |

|

Status |

Senior, unsubordinated |

|

Distribution |

Reg S Cat 1 |

|

Form of the Notes |

Registered |

|

ISIN |

XS1956050923 |

|

Common Code |

195605092 |

|

Principal Amount |

EUR 1,000,000,000.00 |

|

Coupon |

2.75%, annual, ACT/ACT (ICMA) |

|

Pricing Date |

19 February 2019 |

|

Settlement Date |

26 February 2019 (T+5) |

|

Maturity Date |

26 February 2034 |

|

Mid Swap Rate |

1.008% |

|

Reoffer Spread to Mid Swap |

+175 bps |

|

Benchmark |

DBR 4.75 04/07/2034 |

|

Benchmark Yield |

0.344% (ref price of 165.83%) |

|

Reoffer Spread to Benchmark |

+241.4 bps |

|

Reoffer Yield |

2.758% |

|

Reoffer Price |

99.903% |

|

Up-front Fees |

0.20% |

|

All-in Price |

99.703% |

|

All-in Yield |

2.774% |

|

Net Proceeds |

EUR 997,030,000.00 |

|

Redemption |

100.00% of Principal Amount |

|

Business Days |

TARGET 2, Following Business Day Convention, Unadjusted |

|

Documentation |

Issuer’s EMTN Programme dated 1st February 2019 |

|

MiFID product governance |

The target market is professional clients, eligible counterparties and retail (all distribution channels), as defined in MiFID II |

|

CACs |

Yes |

|

NGN/NSS |

Yes; NSS |

|

Law / Listing |

English law / London Stock Exchange, Regulated Market |

|

Denomination |

EUR 1K + 1K |

|

Joint Lead Managers |

Citi, Goldman Sachs International, HSBC |

(AH)

Relevant Press Releases

18-11-2024 14:15

Price Index of Construction Materials: October 2024

15-11-2024 15:12

Road Freight Transport: 2nd Quarter 2024

14-11-2024 13:52

GDP Growth Rate: 3rd quarter 2024 (Flash Estimate)